Ranking 2025: European Freight Villages are important logistics hubs

Italian FV-locations consolidate their dominance in the “TOP 10”

The fourth European freight village ranking compiled by the German Freight Village Association (Deutsche GVZ-Gesellschaft), which has been published every five years, highlights important trends. The study focused on the member countries of the European freight village association Europlat-forms (www.europlatforms.eu), which supported the study as an interest group. The work involved in updating and expanding the European freight village ranking required considerable research effort, but on the other hand – in line with the benchmarking concept – it was able to provide new insights for European freight villages.

The first step was to set up a project team involving, among others, the Europlatforms organisation. This involved the (further) development of (freight village) benchmarking criteria, which took place in a lengthy coordination process at European level. These were criteria from the previous DGG rankings which helped to ensure comparability of the rankings, new key performance indicators and processes.

Another new aspect was introduced through the initial use of AI tools for the detection of existing and new freight village locations, including their infra- and suprastructures. This enabled the identification and selection (update) of suitable benchmarking partners to be finalised based on the available location data. As a result, almost 230 FV-locations were included in the (preliminary) selection, mainly from Europlatforms member countries. Another important component was the development of an online questionnaire/expert guide (in English), which – in addition to structural and process data – primarily contained and reflected current topics and trends in logistics.

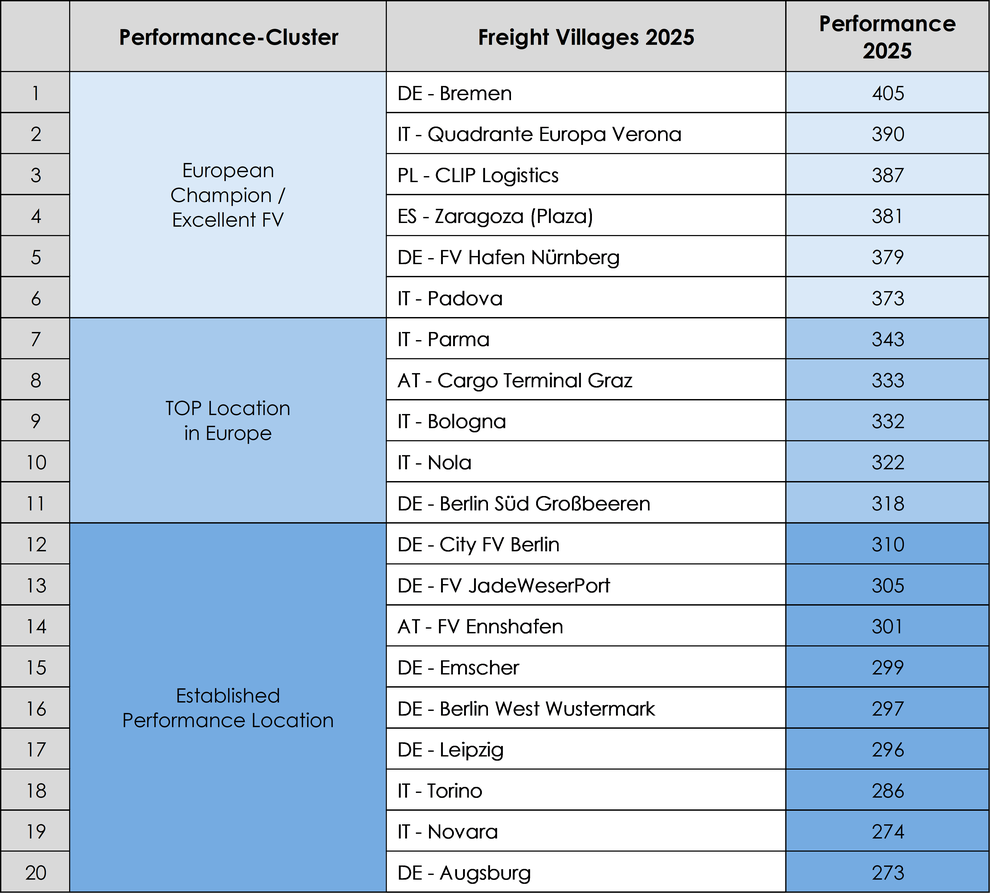

The Bremen freight village can defend its top position in the ranking, although it should be noted that general comparability with the 2020 ranking is only possible to a limited extent due to the increase in the number of evaluation criteria by 1/3 and their partial modification. Next in line are Interporto Quadrante Europa in Verona and, for the first time, the Polish FV location “‘CLIP”’ near Poznań. The location “CLIP” is considered to be one of the most dynamic in Europe in various respects.

Analyses of freight village development levels show that these have continued to increase across Europe over the past five years. The assessments of freight village managers regarding their own freight villages are increasingly aligning with those of their own country or those at the pan-European level.

Assessment of FV development levels in Europe by the respective FV location managers – scale 0–10 (10 very high)

| 2010 | 2015 | 2020 | 2025 | |

| FV developement status in Europe | 5.8 | 6.5 | 6.6 | 6.9 |

| FV developement status own country | 5.2 | 6.2 | 6.9 | 7.2 |

| FV developement status own FV | 6.3 | 7.5 | 8.2 | 7.8 |

The assessments of the respective GVZ location managers regarding the effects/contributions of their locations also provide interesting insights. These were made based on the following FV objectives on a scale of 0 to 10:

(1) Significance of the FV for the region = 8.7

(2) Intermodal transport shift = 8.4

(3) Contributions sustainability (PV and green buildings) = 8.0

(4) ESG (environmental/social/governance) contributions = 7.6

(5) Urban logistics = 7.4

(6) Contributions to the drive transformation (e-mobility, hydrogen) = 6.9

Among other things, it shows that freight village locations throughout Europe – unsurprisingly – are extremely important for their regions. The same applies to intermodal transport, which is virtually part of the ‘DNA’ of freight villages. The topic of photovoltaics has gained significant importance, becoming established at more locations and thus becoming an important component of the (in some cases already accelerated) drive transformation in road freight transport in the future.

The regional importance of European freight villages is reflected in the increase in employment and the attractive range of services on offer (e.g. employee training). Another noteworthy factor is the high degree of centrality of freight village locations, which is evident in their establishment in the European TEN-T networks and their hub functions in combined transport. A new trend is the targeted engagement of individual FV on social media. Although the locations do not (yet) have many followers, an important first step has been taken.

In contrast, challenges are resulting – particularly at German freight village locations – from the lack of options for expanding space. Furthermore, the negative effects of existing trade conflicts and the uncertain overall geopolitical situation are becoming increasingly significant for many European freight villages. At the same time, compared to previous rankings, infrastructure deficiencies are increasingly leading to noticeable impairments.

As in previous European rankings, the current results provide valuable insights that strengthen the role of freight villages as central competence centers of logistics. For example, some freight village managers make use of their ranking positions for external communication, e.g. towards employees, investors and potential new businesses. Good positions or improvements in the ranking can therefore demonstrably serve as important instruments within the respective location strategies. Furthermore, locations in the middle and lower positions of the European ranking benefit from the benchmarks (as points of reference) set by the leading freight villages. In this way, important impulses are generated for all stakeholders at various levels.

Ranking 2025 (TOP 20):

European Freight Village Ranking 2020: Lots of movement in the TOP 10

The DGG's third European GVZ ranking, which has been compiled every five years, provides very important insights into this world. The study focussed on the member countries of the European GVZ umbrella association "Europlatforms" (www.europlatforms.eu), which accompanied the study for the first time. The aim was to generate valuable new insights from the performance comparison of the locations for the further development of freight village centres in Germany and Europe.

|

|

2010 |

2015 |

2020 |

| FV development status Europe in total | 5,8 | 6,5 | 6,6 |

| FV development status own country | 5,2 | 6,2 | 6,9 |

| FV development status own FV | 6,3 | 7,5 | 8,2 |

Where there is light, there is also shadow, so despite all the positive developments, challenges (weaknesses/risks) can also be recognised: A lack of expansion options is demonstrably hampering development at some locations. Even the shortage of skilled labour is no longer a predominantly German challenge. For the first time, risks due to climate impacts have also been comprehensively addressed and confirmed. Furthermore, the negative effects of existing trade conflicts and Brexit were recognised as potential risks.

The assessments of the respective GVZ location managers regarding the effects/contributions of their locations are also interesting. These were based on the following GVZ objectives on a scale from 0 to 10 (= very high)

(1) Importance of the GVZ for the region 8,6

(2) Intermodal modal shift 8,2

(3) Urban logistics 7,4

(4) Green logistics 6,6

It can be seen that the GVZ locations have a very high significance for their regions almost everywhere in Europe. During the analyses/interviews in the ranking process, the GVZ managers sometimes used the term "lighthouse" for their locations.

The findings obtained in the ranking generally provide important insights and facts that strengthen the role of the intermodal centres as central logistics hubs in the awareness of various stakeholders. In addition, local managers benefit from the results of the comparison. Among other things, many management companies use their ranking for their own external presentation, e.g. to investors and potential settlers. The good positions and improvements in the ranking are therefore demonstrably important instruments in the respective marketing strategies. Furthermore, the freight villages in the middle and lower ranking regions of the European ranking benefit from the benchmarks of the leading freight village locations. This provides important impetus for all those involved at all levels.

European Freight Village Ranking 2015

Press Release - 30. November 2015

STEFFEN NESTLER / DR. THOMAS NOBEL

Positioning and Establishment of the Freight Villages (FV) in Europe 2015

German Freight Village Association updated the European Freight Village Ranking

There are many German freight villages which have been successfully positioned and established itself in the market. But what is their position in the European ranking? Could the strong market position be maintained or could there be something to learn from the experience of other European freight villages? These questions became the subject of the study.

The study of the DGG entitled „Positioning and Establishment of the Freight Villages (FV) in Europe is the second of its kind. The first one was carried out by the DGG (involved by the institutes ISL and LUB) in 2010. The current study presents the state of development as well as the development perspective of the European freight villages.

The aim of the data collection is to give an overview to the actors of the single locations about the international field of logistics and to encourage the further development of macro logistics concepts in Europe.

Basis of the study is the definition of the European FV- association “EUROPLATFORMS” relating to freight villages . Accordingly only those locations were chosen that provide characteristics in following fields: Intermodality, Structure of Management, Structure of Services

In the beginning of the survey, over 200 locations from over 30 European countries were identified and contacted. The current ranking includes 40 Benchmarks / Key Performance Indicators (KPI) divided into sixteen clusters. The assessment criteria were expanded by the latest and urgent aspects, as “Green Logistics” and “Security Management”.

Furthermore the position within the TEN-T corridor was observed to take into account the future freight flows in Europe.

The following list gives an overview of the most important findings:

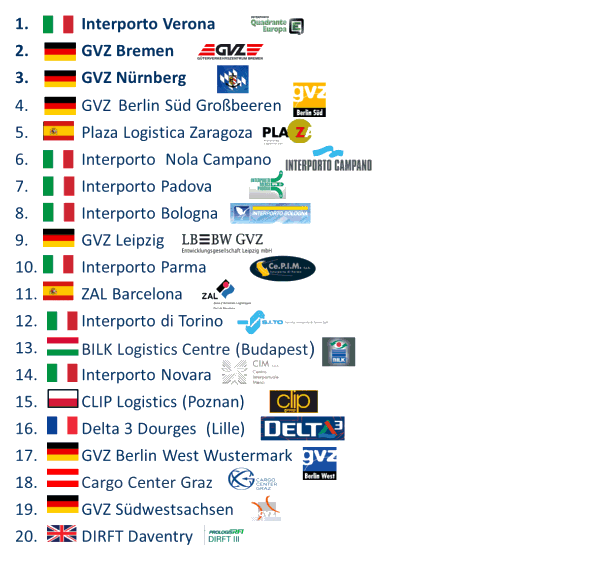

Compared to the first European ranking in 2010, there is no change in 2015 among the TOP 3: Interporto Verona (Italia), GVZ Bremen (Germany) and GVZ Nürnberg. Besides the again good positioned locations, the Freight Village Berlin Süd Großbeeren can be seen as the “real champion” of this ranking, improving the ranking place from the 10th in the last ranking to the 4th in the current ranking. Another notable location is the freight village Leipzig which improved and got ranked within the “Top 10”, due to high number of measurements in employment and in the field of “Green Logistics”. The outstanding success of German Freight Villages is justified through the high Value Added Services that affect positive the employment level, high level of development as well as a high level of terminal capacity. The locations indicate also a remarkable market share of the total supply of real estates in the region.

Beside the German GVZ the Italian Interporti are the leading locations in Europe and therefore represent the international performance standards. A high share of combined transport is concentrated in the north of Italy. The Interporti (Italian name of freight villages) in this region operate as important gateways for the trans-Alpine traffic.

Spain is one of the pioneers of successful establishment of the Freight Village idea. The PLAZA Logistica Zaragoza for example reached 5th place. This was primarily due to the intensive use of the airfreight interface directly established within the FV: There, the global logistics processes of the textile manufacturer Inditex are concentrated - among other things, responsible for the also in Germany very successful fashion brand Zara.

In addition to Germany, Italy, Spain and Eastern Europe, also Delta 3 Dourges (France), Cargo Center Graz (Austria) and DIRFT Daventry (UK) ranked among the top FV.

But also in Eastern Europe the formation achieved success. So two locations from Poland - CLIP in Poznan - and from Hungary - BILK in Budapest - could improve and reached the “Top 20” as well. Funding for railways and intermodal terminals promote the development of Freight Villages, as for example in Poland. The automotive and logistics supplier are the main consumer of services the East European Freight Villages providing their development. The logistics real estate companies use also the favorable location of freight villages and offer their services to achieve PPP Solutions.

By contrast with the ranking 2010, the stage of development, not only throughout Europe, but also in the single countries and the Freight Villages themselves, has increased noticeably. Some new Freight Villages entered the current ranking. This success proves the success of freight village concept and promotes its development in Europe.